What Are Liquidity Pools on Ethereum and How Do They Work?

What Are Liquidity Pools? A Simple Introduction

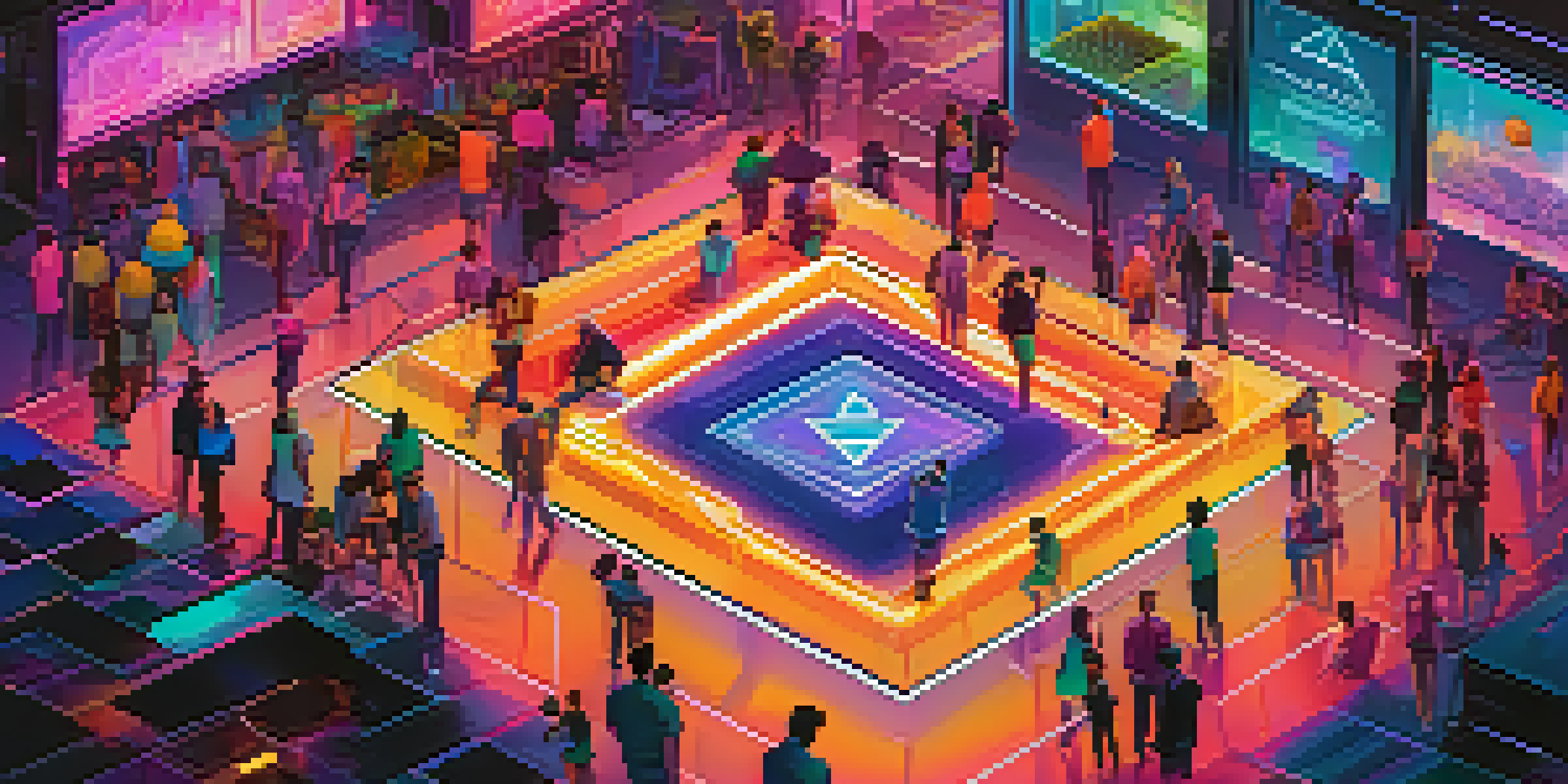

Liquidity pools are a crucial component of decentralized finance (DeFi) on Ethereum. They consist of a collection of tokens locked in a smart contract, which facilitates trading and provides liquidity to users. Think of them as communal swimming pools filled with digital assets that anyone can dip into for trading purposes.

Liquidity pools are reshaping the way we think about trading and liquidity in the DeFi space.

These pools are designed to ensure that there's always enough liquidity available for traders, preventing price slippage and encouraging smoother transactions. When a trader wants to swap one token for another, they can do so directly from the pool, rather than relying on a traditional exchange's order book.

By pooling their assets together, users can earn rewards in the form of transaction fees, making liquidity pools an attractive option for both casual and seasoned investors. This collaborative approach helps create a robust trading environment that benefits everyone involved.

How Do Liquidity Pools Work? The Mechanics Explained

At the heart of liquidity pools is the concept of Automated Market Makers (AMMs), which replace traditional market makers. AMMs use algorithms to set prices based on the ratio of assets in the pool, enabling direct token swaps without needing an intermediary. This mechanism allows for continuous trading, regardless of market conditions.

When users deposit tokens into a liquidity pool, they receive liquidity provider (LP) tokens in return. These LP tokens represent their share of the pool and can be used to withdraw their original tokens plus a portion of the fees generated from trades. It's a win-win situation!

Liquidity Pools Enable Efficient Trading

Liquidity pools allow users to trade tokens directly, ensuring there is always enough liquidity to prevent price slippage.

This system not only democratizes trading but also incentivizes users to contribute to the pool, enhancing overall liquidity. The more liquidity present, the more efficient and stable the trading experience becomes for everyone.

Benefits of Using Liquidity Pools on Ethereum

Liquidity pools offer several advantages, particularly within the Ethereum ecosystem. One of the primary benefits is the ability for users to earn passive income by providing liquidity. As trades are executed, a fraction of the fees goes to liquidity providers, allowing them to earn rewards without actively managing their investments.

In decentralized finance, liquidity is not just about assets; it's about creating an inclusive financial ecosystem.

Additionally, liquidity pools promote decentralized trading, reducing reliance on centralized exchanges that can impose high fees and restrictions. This opens up opportunities for anyone with an internet connection to trade assets without facing unnecessary hurdles.

Moreover, liquidity pools help stabilize prices by ensuring that there is always enough liquidity available. This means traders can swap tokens with minimal price impact, leading to a more efficient market overall.

Risks Involved with Liquidity Pools

While liquidity pools provide numerous benefits, they also come with inherent risks that users should be aware of. One major risk is impermanent loss, which occurs when the price of pooled tokens diverges significantly. This means that if you withdraw your tokens later, you might end up with less value than if you had simply held onto them.

Another risk is smart contract vulnerabilities. Since liquidity pools operate through smart contracts, any bugs or exploits in the code could lead to a loss of funds. It's crucial to thoroughly research and select reputable projects to mitigate this risk.

Earning Passive Income with LPs

By providing tokens to liquidity pools, users can earn passive income through transaction fees while participating in a decentralized trading environment.

Lastly, there’s the risk of market volatility. Sudden price swings can lead to rapid changes in your share of the pool, affecting your overall returns. Being aware of these risks can help you make informed decisions when participating in liquidity pools.

Popular Liquidity Pools on Ethereum You Should Know

There are several well-known liquidity pools on the Ethereum network that have gained popularity among users. Uniswap is perhaps the most recognized, allowing users to create and trade tokens easily. Its user-friendly interface and extensive range of supported tokens make it a favorite for both novice and experienced traders.

Another notable platform is SushiSwap, which started as a fork of Uniswap but has since added unique features, including yield farming opportunities for liquidity providers. This added functionality can enhance potential earnings for users willing to participate.

Lastly, Balancer is worth mentioning for its innovative approach that allows users to create custom liquidity pools with varying ratios of tokens. This flexibility can cater to different trading strategies, making it a versatile option for liquidity providers.

How to Get Started with Liquidity Pools

Getting started with liquidity pools is relatively straightforward, even for those new to the DeFi space. First, you'll want to select a platform that aligns with your needs, such as Uniswap or SushiSwap. Once you've chosen a platform, you'll need to connect a cryptocurrency wallet, such as MetaMask, to facilitate transactions.

After connecting your wallet, you can deposit the tokens you'd like to contribute to the liquidity pool. Make sure to check the pool's requirements, as some may require you to deposit pairs of tokens in specific ratios. Once your tokens are deposited, you'll receive LP tokens in return, representing your share in the pool.

Understanding Risks in Liquidity Pools

Investors should be aware of risks like impermanent loss and smart contract vulnerabilities when engaging with liquidity pools.

Finally, keep an eye on your investment and the overall market conditions. Many platforms provide dashboards to track your earnings and liquidity position, so you can adjust your strategy as needed. With a bit of research and patience, you'll be well on your way to participating in the exciting world of liquidity pools.

The Future of Liquidity Pools and DeFi

As the DeFi space continues to evolve, liquidity pools are poised to play an even more significant role in the future of finance. With innovations like layer-2 solutions and cross-chain interoperability, the efficiency and accessibility of liquidity pools are expected to improve dramatically. This could lead to a broader adoption of DeFi platforms.

Moreover, as more users become aware of the benefits and opportunities presented by liquidity pools, we may see an influx of new participants contributing liquidity. This growing interest could further enhance the stability and efficiency of decentralized trading systems.

Ultimately, the future of liquidity pools seems promising, with the potential to revolutionize how we interact with financial markets. By embracing this technology, we can pave the way for a more inclusive and decentralized financial landscape.